THIS ISSUE'S HEADLINES

IRS Targets Monetized Installment Sales in Proposed Regulations

Comprehensive Changes to Land Use and Zoning Laws

Florida Cannabis Laws Update

IRS TARGETS MONETIZED INSTALLMENT SALES IN PROPOSED REGULATIONS

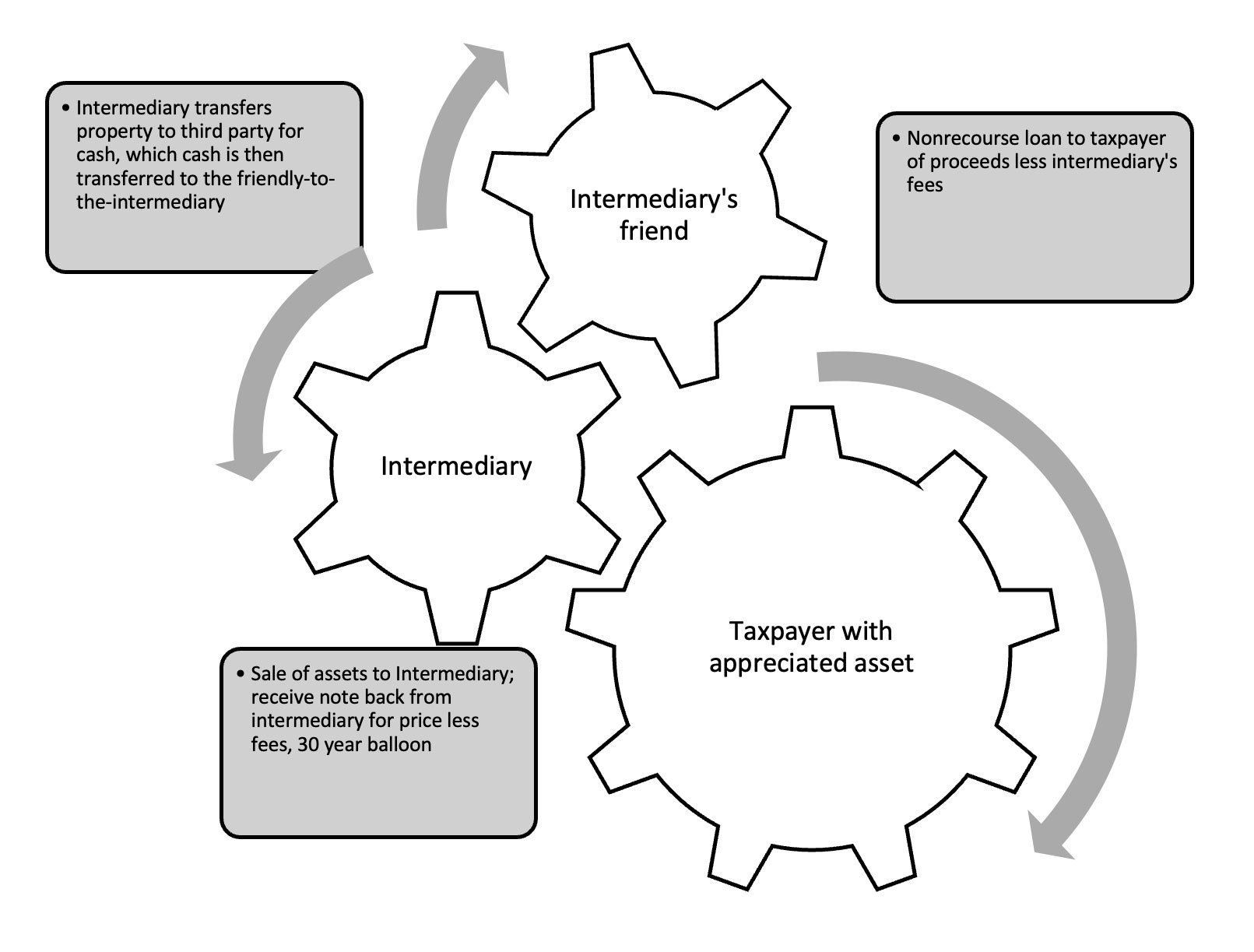

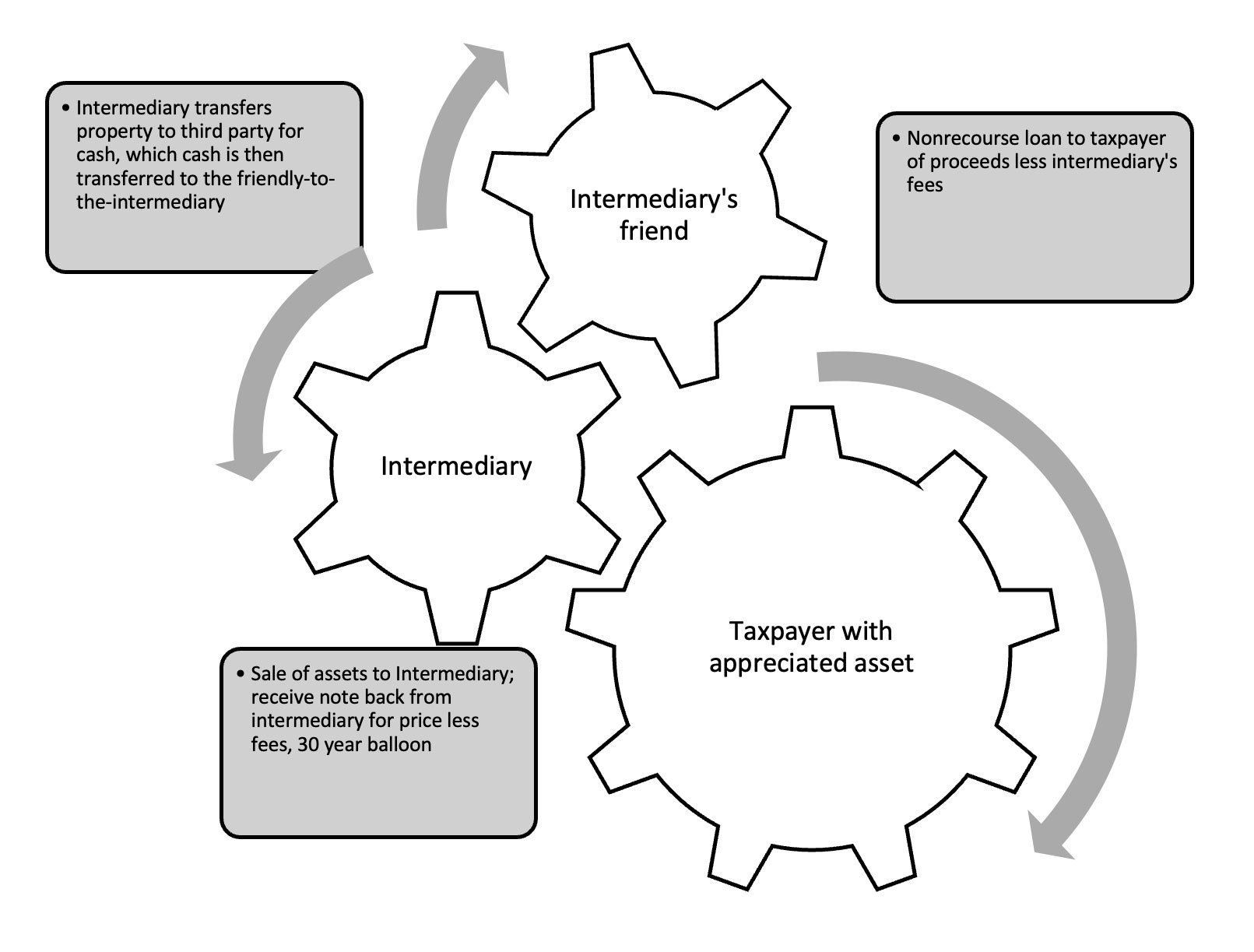

IRS Commissioner Werfel has continued the theme from the Dirty Dozen list published in early 2023 to promulgate regulations regarding monetized installment sales. This particular brand of transaction has been marketed to high income individuals with the promise of a “penny deferred is a penny saved.” The IRS has indicated that in certain forms, these types of transactions will be deemed abusive, and subject the taxpayer to significant penalties. IRS Commissioner Werfel has continued the theme from the Dirty Dozen list published in early 2023 to promulgate regulations regarding monetized installment sales. This particular brand of transaction has been marketed to high income individuals with the promise of a “penny deferred is a penny saved.” The IRS has indicated that in certain forms, these types of transactions will be deemed abusive, and subject the taxpayer to significant penalties.

These transactions seek to utilized section 453 of the Internal Revenue Code to defer gain on the sale of an asset. At its base level, the transaction occurs as follows:

- Individual taxpayer has an appreciated asset that he sells to the intermediary- who is often also the promoter of this style of transaction.

- The purchase price is received by the taxpayer by way of an interest only balloon installment loan- often for a term of thirty years.

- The intermediary/promoter then flips the asset to the ultimate buyer for cash.

- The taxpayer will not owe tax on the gain from the transaction until the balloon comes due. So far so good…

- The intermediary, recognizing the taxpayer may not want to wait thirty years for his money, then finds another party to loan the taxpayer a large percentage of the proceeds in an unsecured, nonrecourse loan. Since the loan is nonrecourse, the taxpayer is not in receipt of the sales proceeds (arguably).

- The interest income from the original note is paid to an escrow account, which then makes payments on the second note, the taxpayer gets to deduct the interest payments made on the second note, which offsets the interest the taxpayer receives on the first note.

What’s not to like about this? The unsecured nonrecourse debt means the borrower has no actual liability to repay the loan - thus it is not a “real” debt and the loan is income to the taxpayer. Further, the IRS has taken the position that if you defer taxes under s. 453, and then pledge the loan to secure another loan, there is a deemed payment and income tax. What’s not to like about this? The unsecured nonrecourse debt means the borrower has no actual liability to repay the loan - thus it is not a “real” debt and the loan is income to the taxpayer. Further, the IRS has taken the position that if you defer taxes under s. 453, and then pledge the loan to secure another loan, there is a deemed payment and income tax.

The IRS has proposed to identify monetized installment sales as listed transactions, which requires reporting. The reporting obligations would fall to both the material advisor, as well as participants, and there would be penalties if you fail to report.

If you have questions pertaining to monetized installment sales or any other tax, estate and trust planning matters, please contact Attorney Leah A. Foertsch, Managing Partner of our Boca Raton, FL office, at 561-362-2030 or email lfoertsch@pldolaw.com.

[back to top]

COMPREHENSIVE CHANGES TO LAND USE AND ZONING LAWS

As part of the 2023 legislative session, the Rhode Island General Assembly passed numerous laws, all with varying degrees of impact on zoning and land use issues. One such bill changes the standard by which municipal zoning boards judge applications for a dimensional variance. As part of the 2023 legislative session, the Rhode Island General Assembly passed numerous laws, all with varying degrees of impact on zoning and land use issues. One such bill changes the standard by which municipal zoning boards judge applications for a dimensional variance.

Previously, part of the standard included a determination of whether or not the application resulted primarily from the desire of the applicant to realize greater financial gain and whether the relief to be granted was the least relief necessary. Both of these criteria often proved difficult to judge, as it could be argued for almost every application that the desire of the applicant was greater financial gain (i.e. property value) and that the relief sought was not the least relief necessary (i.e. why not a few feet less?). Both of these standards were deleted as required findings, such that a dimensional variance now only needs to show that: (1) the hardship is due to the unique characteristics of the property; (2) the hardship is not the result of any prior action of the applicant; (3) the granting of the variance will not alter the general character of the surrounding area or impair the intent of the zoning ordinance; and (4) if the variance is not granted, it will amount to more than a mere inconvenience, which means that the relief sought is minimal to a reasonable enjoyment of the permitted use to which the property is to be devoted. In amending and clarifying the standard for a dimensional variance, the General Assembly brought clarity to both applicants and the members of Zoning Boards that must deliberate on the applications.

Other legislative changes include the following matters:

• Uniform notice and advertising requirements;

- Creation of a dedicated Zoning/Land Use calendar in the Superior Court;

- Repeal of the RI State Housing Appeals Board;

- Adaptive reuse of commercial structures into residential developments;

- Amendments to Comprehensive Planning, including adoption and consistency of applications, and;

- Amendments to subdivision and land development permitting process.

If you have questions about land use or zoning laws, please contact PLDO Partner Patrick J. McBurney at 401-824-5100 or email pmcburney@pldolaw.com.

[back to top]

FLORIDA CANNABIS LAWS UPDATE

While Florida Governor Ron DeSantis has made clear his opposition to legalizing recreational cannabis use in Florida, trends certainly seem like they are going in that direction. For example, in April, the state doubled the number of licenses available to cultivators and retailers. Recently, a new law signed by the Governor makes medical marijuana prescription renewals easier. And finally, the question of recreational cannabis itself has received enough signatures to be on the ballot in 2024 as a constitutional amendment. While Florida Governor Ron DeSantis has made clear his opposition to legalizing recreational cannabis use in Florida, trends certainly seem like they are going in that direction. For example, in April, the state doubled the number of licenses available to cultivators and retailers. Recently, a new law signed by the Governor makes medical marijuana prescription renewals easier. And finally, the question of recreational cannabis itself has received enough signatures to be on the ballot in 2024 as a constitutional amendment.

This summer, Governor DeSantis signed HB 387 into law, which can be considered as expanding Florida’s medical marijuana program. The new law allows existing medical marijuana patients to use telehealth visits, rather than in-person exams, to renew their prescriptions. Previously, a patient would have to visit their physician in person to renew a prescription.

The new law also provides additional medical marijuana licenses to Florida’s black farmers. Under prior law, the Florida Department of Health was required to issue a single license to a class member of the Pigford v. Glickman/In Re Black Farmers class action case. The new law requires that a medical marijuana license be issued to any farmer that is a class member, provided there are no deficiencies in the application (class members must still go through the competitive application process).

Finally, earlier this summer, Florida officials released information that a proposal to amend the state constitution to legalize marijuana for recreational use had received enough signatures to be placed on the ballot. However, before it can be placed on the ballot, the Florida Supreme Court must review the proposal to ensure that the proposal is limited to a single issue and will not confuse voters. Florida’s attorney general has already challenged the proposal on those grounds. While the legalization of recreational cannabis may still be up in the air, continued expansion of Florida’s medical marijuana program seems likely over the coming years.

Joshua J. Butera is Senior Counsel with Pannone Lopes Devereaux & O’Gara LLC and a member of the Corporate & Business Law, Municipal Law and Cannabis Law Teams. If you have questions or would like more information, Attorney Butera can be reached at 561-362-2030 or jbutera@pldolaw.com.

[back to top]

|

IRS Commissioner Werfel has continued the theme from the Dirty Dozen list published in early 2023 to promulgate regulations regarding monetized installment sales. This particular brand of transaction has been marketed to high income individuals with the promise of a “penny deferred is a penny saved.” The IRS has indicated that in certain forms, these types of transactions will be deemed abusive, and subject the taxpayer to significant penalties.

IRS Commissioner Werfel has continued the theme from the Dirty Dozen list published in early 2023 to promulgate regulations regarding monetized installment sales. This particular brand of transaction has been marketed to high income individuals with the promise of a “penny deferred is a penny saved.” The IRS has indicated that in certain forms, these types of transactions will be deemed abusive, and subject the taxpayer to significant penalties. What’s not to like about this? The unsecured nonrecourse debt means the borrower has no actual liability to repay the loan - thus it is not a “real” debt and the loan is income to the taxpayer. Further, the IRS has taken the position that if you defer taxes under s. 453, and then pledge the loan to secure another loan, there is a deemed payment and income tax.

What’s not to like about this? The unsecured nonrecourse debt means the borrower has no actual liability to repay the loan - thus it is not a “real” debt and the loan is income to the taxpayer. Further, the IRS has taken the position that if you defer taxes under s. 453, and then pledge the loan to secure another loan, there is a deemed payment and income tax. As part of the 2023 legislative session, the Rhode Island General Assembly passed numerous laws, all with varying degrees of impact on zoning and land use issues. One such bill changes the standard by which municipal zoning boards judge applications for a dimensional variance.

As part of the 2023 legislative session, the Rhode Island General Assembly passed numerous laws, all with varying degrees of impact on zoning and land use issues. One such bill changes the standard by which municipal zoning boards judge applications for a dimensional variance.  While Florida Governor Ron DeSantis has made clear his opposition to legalizing recreational cannabis use in Florida, trends certainly seem like they are going in that direction. For example, in April, the state doubled the number of licenses available to cultivators and retailers. Recently, a new law signed by the Governor makes medical marijuana prescription renewals easier. And finally, the question of recreational cannabis itself has received enough signatures to be on the ballot in 2024 as a constitutional amendment.

While Florida Governor Ron DeSantis has made clear his opposition to legalizing recreational cannabis use in Florida, trends certainly seem like they are going in that direction. For example, in April, the state doubled the number of licenses available to cultivators and retailers. Recently, a new law signed by the Governor makes medical marijuana prescription renewals easier. And finally, the question of recreational cannabis itself has received enough signatures to be on the ballot in 2024 as a constitutional amendment.