| |

THIS ISSUE'S HEADLINES

Medicaid Planning and the Caregiver Child Exception

Creating Legal Documents: Are You Using The “Right Tool” for the Job?

Important Steps & Considerations If Your Family Business is Considering an ESOP

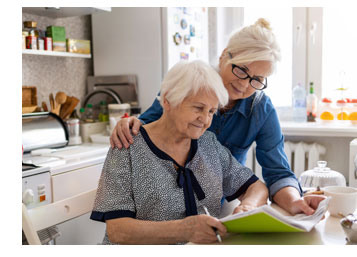

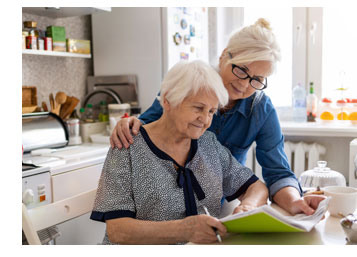

MEDICAID PLANNING AND THE CAREGIVER CHILD EXCEPTION

In this day and age, there is no denying that prices for most things are skyrocketing and skilled care for an aging parent is no exception. If an aging parent’s health has declined significantly enough, the parent could face the prospect of admission to a nursing home despite their children’s best efforts to keep them living in their home. Medicaid planning performed by a skilled lawyer or financial planner can help ease the financial burden of nursing home care by ensuring the best possibility of acceptance into the Rhode Island Medicaid program. In this day and age, there is no denying that prices for most things are skyrocketing and skilled care for an aging parent is no exception. If an aging parent’s health has declined significantly enough, the parent could face the prospect of admission to a nursing home despite their children’s best efforts to keep them living in their home. Medicaid planning performed by a skilled lawyer or financial planner can help ease the financial burden of nursing home care by ensuring the best possibility of acceptance into the Rhode Island Medicaid program.

Normally, one of the most valuable assets an aging parent owns is their home. Unless it is properly protected, the Rhode Island Department of Health and Human Services will seek to recover against the home upon the passing of the Medicaid recipient for any benefits provided during life. This is known as State Recovery. For those families that have not planned in advance, one way to protect a home against State Recovery, which is often overlooked, is the caregiver child exception. This allows an elderly person to transfer their primary residence to their adult child who has been caring for the parent.

To benefit from this exception, the child must live in the home and show, to the State’s satisfaction, that he or she served as the primary caregiver of the parent for at least two years immediately before admission to the nursing home. 210-RICR-50-00-6.5.3 (B)(2)(e)(4). The care that the child renders must be such that it enables the parent to continue to live at home and delays the parent from needing to enter a nursing home during that two-year period. While this sounds easy enough, the State interprets this exception extremely strictly and documentation is required. When beginning the process of Medicaid planning or attempting to use the caregiver child exception when earlier planning has not been done, it is advisable to seek competent legal assistance.

If you have questions about Medicaid planning, please contact PLDO Partner Gene M. Carlino or Attorney Paige E. Macnie at 401-824-5100, gmcarlino@pldolaw.com or pmacnie@pldolaw.com.

[back to top]

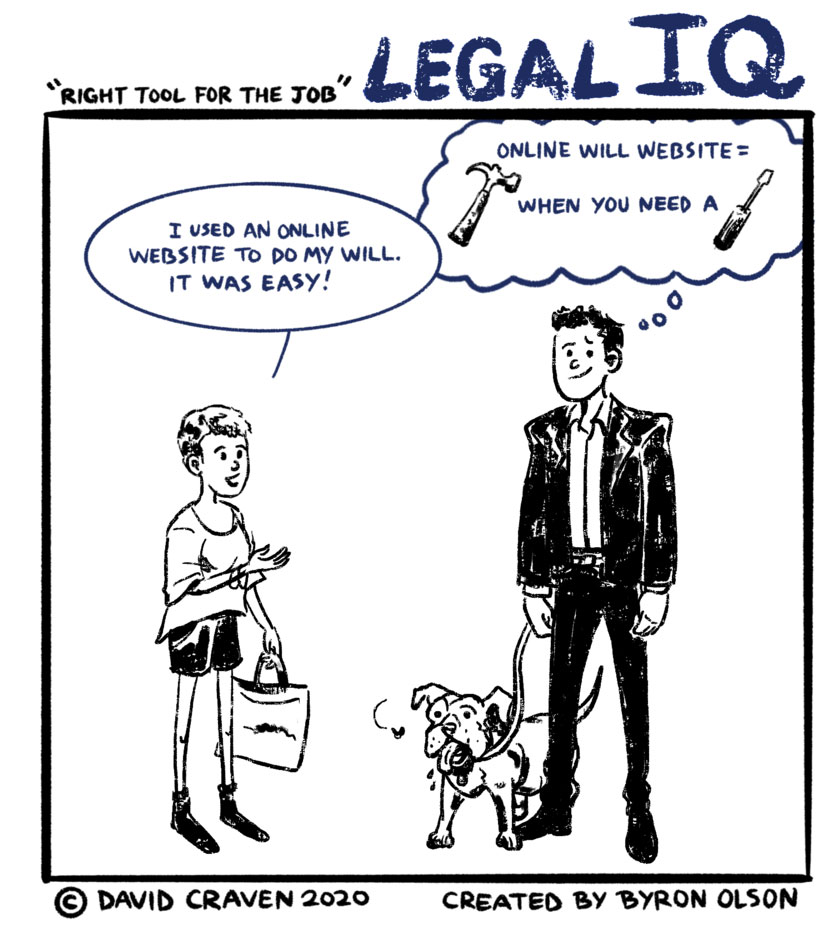

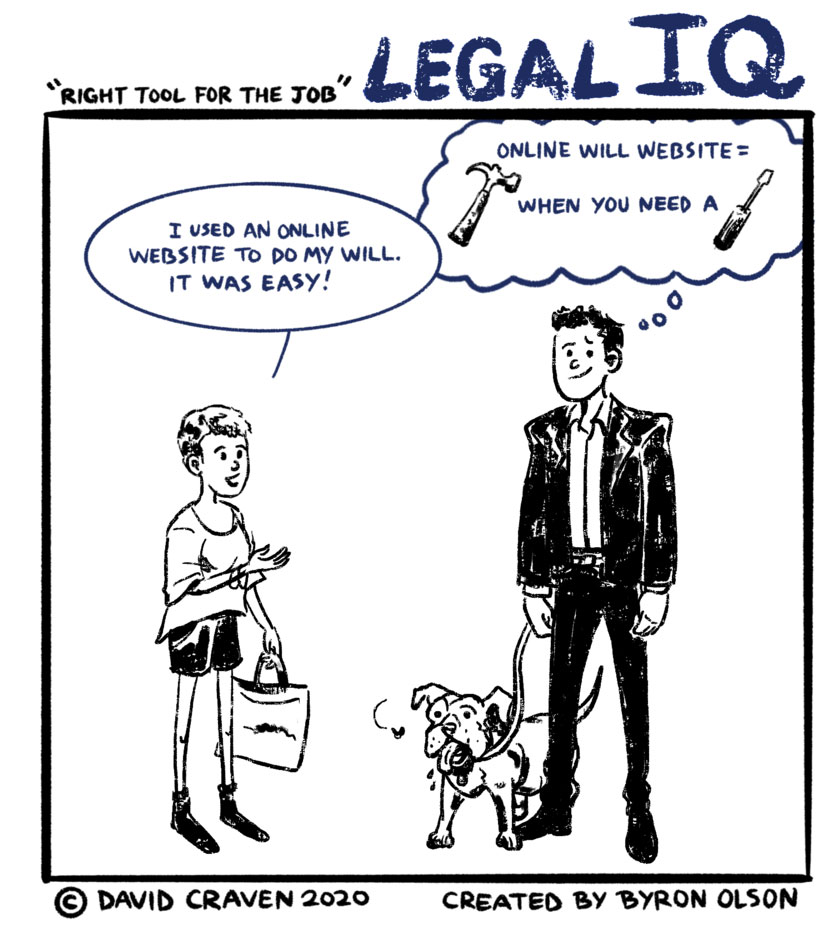

CREATING LEGAL DOCUMENTS: ARE YOU USING THE “RIGHT TOOL” FOR THE JOB?

When it comes to crafting your legal documents, such as Wills, LLC formations, etc., there are endless options. Should you utilize an online tool, such as Legal Zoom, or seek a legal professional to produce your legal documents? In this article, PLDO Trust & Estate Partner David Craven explains the differences and important considerations:

Online tools have boiler plate templates that are unable to take into account specific situations and often have incorrect or contradictory clauses. They also often do not have proper conflict resolution information built in, which can result in messy court battles. And a computer algorithm cannot understand, nor consider, your specific wishes for yourself and your loved ones.

Essentially, online tools are not able to process the information in a personal, sophisticated fashion, like a professional can, and you end up with a document which likely does not meet your needs. It will leave out important information that may result in your loved ones not being cared for the way you intended.

People often forget that lawyers go to years of schooling, then do “on the job training”, plus continuing legal education, before they ever produce something a client is going to get. It’s hard to believe that “fill in the blanks” can listen, understand your goals, and produce a document that achieves your objectives.

Simply put, if you just want to fill in the blanks on a document, use an online tool. But if you want guidance on how to create a plan that will ensure you and your loved ones are cared for in the event of death or disability, it’s best to go to a lawyer.

Let’s equate it to an English class and two different assignments. With the first assignment you’re allowed to write a creative story. You have so many options open to you to write the story you want and are not confined by any prescribed bounds. The second assignment would be an exercise where the storyline was already typed out for you and you were only able to fill in some of the adjectives. Easier in some regard; certainly quicker. But you might not like the storyline at all, and you are stuck with that. That, in a nutshell, is the difference between using a lawyer and an online tool.

Here’s another example (pet owners, take note!): Here’s another example (pet owners, take note!):

You have a dog – let’s call him “Frankie” - that you consider to be a beloved member of your family. In your Will, you want to leave Frankie to your friend, “Bob,” along with money to care for your dog.

The online tool might allow you to fill out the name of the person who will care for your dog and an amount of money that would enable the person to do so. A boiler plate / ”fill in the blank” Will might say “I leave my dog Frankie to my friend Bob. I also leave Bob $10,000.00 for the care of Frankie.”

But what if Frankie is no longer around when you die and you have a new dog? Well, the Will doesn’t address that and there would be an issue.

Also, what if Bob gets Frankie, and the $10,000, and decides to immediately turn Frankie over to the animal shelter and keep the $10,000? The online Will can’t address that either.

A lawyer can talk through these options with you, understand that you want your friend to get any pets you own, and ensure documents are prepared so that any money you leave is only used for the purposes you intend.

This is just one example, but there are so many more issues involving family homes, second marriages (providing for the spouse from your current marriage and children from former marriage), and guardianship for children. These all require personal conversations to understand your goals; something an online program cannot help you with. Often issues with incomplete or contradicting information can be so large, that the entire document is completely ineffective. Essentially, you paid for nothing.

Another way to think of legal work is like home renovations projects. You want to choose the right tool for the job; otherwise, it’s impossible to get the job done correctly. If you grab whatever tool you have closest to you, to try and force the result, you often end up making a mess that, in the long run, might result in a bigger and more costly headache.

For important legal documents, most times, a lawyer is the right choice over trusting your fate with an online tool. If you have questions pertaining Wills or other legal documents, please contact David P. Craven, Esquire at 401-824-5100 or email dcraven@pldolaw.com.

[back to top]

IMPORTANT STEPS & CONSIDERATIONS IF YOUR FAMILY BUSINESS IS CONSIDERING AN ESOP

An Employee Stock Ownership Plan (“ESOP”) can provide unique benefits to both the owners of a family business, as well as its employees. Many businesses implement ESOPs in order to capitalize on tax advantages, formulate a business succession plan, raise capital or build debt capacity, and provide their employees with a retirement benefit that fosters a sense of ownership and engagement. An Employee Stock Ownership Plan (“ESOP”) can provide unique benefits to both the owners of a family business, as well as its employees. Many businesses implement ESOPs in order to capitalize on tax advantages, formulate a business succession plan, raise capital or build debt capacity, and provide their employees with a retirement benefit that fosters a sense of ownership and engagement.

However, executing an ESOP in a family business setting involves several steps and considerations that require the guidance of experienced financial and legal professionals. PLDO Managing Principal Gary R. Pannone discusses the purpose of an ESOP as a qualified retirement plan and what family business owners need to consider prior to implementing. Click here to learn more and if you have questions pertaining ESOPs, please contact Attorney Pannone at 401-824-5100 or email gpannone@pldolaw.com.

[back to top]

|

|

In this day and age, there is no denying that prices for most things are skyrocketing and skilled care for an aging parent is no exception. If an aging parent’s health has declined significantly enough, the parent could face the prospect of admission to a nursing home despite their children’s best efforts to keep them living in their home. Medicaid planning performed by a skilled lawyer or financial planner can help ease the financial burden of nursing home care by ensuring the best possibility of acceptance into the Rhode Island Medicaid program.

In this day and age, there is no denying that prices for most things are skyrocketing and skilled care for an aging parent is no exception. If an aging parent’s health has declined significantly enough, the parent could face the prospect of admission to a nursing home despite their children’s best efforts to keep them living in their home. Medicaid planning performed by a skilled lawyer or financial planner can help ease the financial burden of nursing home care by ensuring the best possibility of acceptance into the Rhode Island Medicaid program.  Here’s another example (pet owners, take note!):

Here’s another example (pet owners, take note!): An Employee Stock Ownership Plan (“ESOP”) can provide unique benefits to both the owners of a family business, as well as its employees. Many businesses implement ESOPs in order to capitalize on tax advantages, formulate a business succession plan, raise capital or build debt capacity, and provide their employees with a retirement benefit that fosters a sense of ownership and engagement.

An Employee Stock Ownership Plan (“ESOP”) can provide unique benefits to both the owners of a family business, as well as its employees. Many businesses implement ESOPs in order to capitalize on tax advantages, formulate a business succession plan, raise capital or build debt capacity, and provide their employees with a retirement benefit that fosters a sense of ownership and engagement.