|

THIS ISSUE'S HEADLINES

Changes In The Wind For Retirement Benefits – Possible

Estate Planning Ideas In A Low Interest Rate Environment

Why Call Florida Home?

The Importance of Keeping Your Estate Plan Current

CHANGES IN THE WIND FOR RETIREMENT BENEFITS – POSSIBLE

Last spring the United States House of Representatives by an over whelming majority passed the most significant changes to the IRA/401(k) laws since their original passage in the mid 1970’s. If signed into law these changes will:

• allow part-time workers who work less than 1,000 hours a year to contribute to a 401(k) plan; • allow part-time workers who work less than 1,000 hours a year to contribute to a 401(k) plan;

• allow contributions to IRAs after the existing age 701ŕ2 age limit;

• delay the age for the start of required minimum distributions to 72;

• allow penalty free early withdrawals from a retirement account of up to $5,000 per parent f or the birth or adoption of a child; and,

• allow small employers who may not otherwise be able to afford the administrative costs of a 401(k) plan to band together and offer a pooled 401(k) plan; and,

• liberalize the rules related to annuity investments for 401(k)s with the goal of creating lifetime income retirement benefits.

To offset the Federal Government’s loss of tax revenue caused by these changes, the proposed law provides, with certain exceptions, that a beneficiary of deceased person’s IRA or 401(k) can no longer stretch out distributions over the beneficiary’s own lifetime. Under the new proposed law, a beneficiary must now withdraw the entire plan balance within 10 years of the date of the original account owner’s death. The exception applies when the beneficiary is a spouse, a minor child or a disabled or terminally ill person. Unfortunately, the exception does not extend to a trust established for a person in this class unless all other beneficiaries in the trust fit are in one of these classes, which is uncommon.

Before the new law can be presented to the President for signature, the Senate must pass the bill passed by the House. To avoid debate on the Senate floor, the bill must pass unanimously. As of the last count, three US Senators were holding out on commitments to vote for passage. If the bill is not passed unanimously by the Senate there appears some risk that the bill will not make it to the Senate Floor due to competition with other legislative and political priorities. We won’t know for sure what will happen until Congress reconvenes after the summer recess on September 9th. Stay tuned and we will be sure to update you. For more information about the legislation or estate planning, tax and retirement strategies and retirement planning, please contact PLDO Partner Gene M. Carlino in Rhode Island at 401-824-5100 or in our Florida office at 561-362-2030 or email gcarlino@pldolaw.com.

[back to top]

ESTATE PLANNING IDEAS IN A LOW INTEREST RATE ENVIRONMENT

With the Fed’s recent interest rate cut and more interest rate reductions likely on the way, this may be a good time to take advantage of the low interest rate environment to transfer assets to your beneficiaries with minimal tax consequences and significant benefits to your beneficiaries.

One strategy is to create a trust called a grantor retained annuity trust (“GRAT”) and transfer highly appreciated assets to the GRAT. The terms of the GRAT would state that you would receive a stream of income payments (the annuity) for yourself over a certain term of years. When the term designated for the annuity expires, the beneficiaries you’ve designated would receive whatever assets are left in the GRAT. One strategy is to create a trust called a grantor retained annuity trust (“GRAT”) and transfer highly appreciated assets to the GRAT. The terms of the GRAT would state that you would receive a stream of income payments (the annuity) for yourself over a certain term of years. When the term designated for the annuity expires, the beneficiaries you’ve designated would receive whatever assets are left in the GRAT.

When the GRAT investments outperform the IRS mandated minimal interest rate for the annuity (currently, 2.2%), the excess passes to your beneficiaries free from any federal gift tax. This is easier to accomplish when the interest rate is low, making a GRAT a more effective estate planning strategy in a low interest rate environment.

If you are charitably inclined, now may be a good time to create a Charitable Lead Annuity Trust. A Charitable Lead Annuity Trust, or “CLAT,” is similar to a GRAT except that, instead of you receiving the initial stream of annuity payments, you designate a charity to receive them. When the Trust ends, the remainder goes to the beneficiaries named in the Trust.

As with a GRAT, if the CLAT’s investments out-earn the IRS mandated interest rate, the excess passes to your beneficiaries are free from any federal transfer taxes. This is another instance in which very low interest rates can mean the opportunity to pass on large amounts to your loved ones while minimizing your tax bill.

A third strategy that might be useful is a low-interest loan to family members. You are generally required to charge an adequate interest rate on the loan for the use of the money, or interest will be deemed to be charged for income tax and gift tax purposes. However, with the current low interest rates, you can provide loans at a very low rate and family members can effectively keep any earnings in excess of the interest they are required to pay you. If you would like to discuss your estate and trust planning options, please contact PLDO Senior Counsel Jason S. Palmisano in our Florida office at 561-362-2030 or email jpalmisano@pldolaw.com.

[back to top]

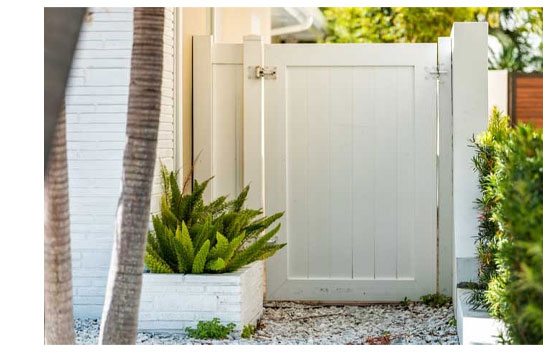

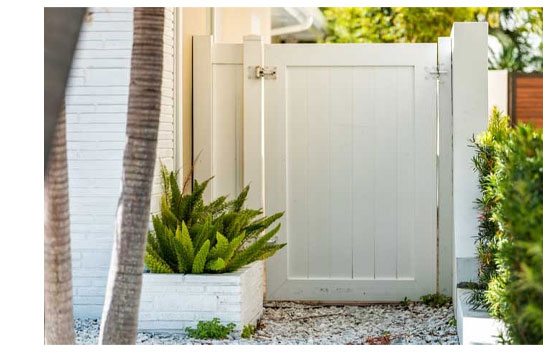

WHY CALL FLORIDA HOME?

Economic forecasters are predicting significant growth in Florida’s population through 2024, estimating just over 300,000 new residents per year. That’s no surprise with the sunshine, beaches and abundance of outdoor living and activities that come with a Florida lifestyle. If you think Florida is calling you, before you make the move, consider these important factors to help smooth your migration to the Sunshine State and reap all of the state’s advantages.

The “How” The “How”

To establish Florida as your domicile, two elements are necessary: a physical presence and an intent to permanently reside. Physical residence is objective and can be established by home ownership or renting. Establishing “intent” is a bit more subjective and difficult. Generally, you must show that you are committed to Florida (and equally committed to leaving your current state). To do so, you can register to vote, join civic or religious organizations, change your driver’s license and car registration, and open an account at a local bank. Additional evidence to prove Florida residency includes filing a Declaration of Domicile, filing for Homestead Exemption, and establishing new estate planning documents. Establishment of your new domicile needs to be as unambiguous as possible, for both the state you are leaving as well as Florida. You should keep receipts and other evidence in case you are challenged by either state.

The “Why”

Beyond Florida’s drawcard of sunny weather and outdoor attractions, there are several tax advantages as well. Chiefly, they include:

1. Florida does not have a state income tax, and counties and municipalities cannot levy an income tax;

2. Florida does not impose an estate tax;

3. Florida provides asset protection via homeownership;

4. Florida caps property tax assessments on homestead property; and

5. The sunshine! The beaches!

Establishing a new domicile is a formal process, and traps for the unwary are plentiful. You should work with a qualified advisor to help you to avoid the pitfalls and make it an easy transition. If you would like further information, please contact PLDO Senior Counsel Leah A. Foertsch in our Florida office at 561-362-2030 or email lfoertsch@pldolaw.com.

[back to top]

THE IMPORTANCE OF KEEPING YOUR ESTATE PLAN CURRENT

Often times clients spend time and money investing in a proper estate plan. However, as time passes it is important to revisit your estate plan for several reasons.

Life circumstances are constantly evolving due to a death, marriage, divorce, birth or a change in family relationships. Reviewing the terms of your wills, trusts, powers of attorney and health care agents is important to ensure the documents reflect your current wishes. Life circumstances are constantly evolving due to a death, marriage, divorce, birth or a change in family relationships. Reviewing the terms of your wills, trusts, powers of attorney and health care agents is important to ensure the documents reflect your current wishes.

Also, with the passage of time, our estate plan objectives may change. An estate plan that was proper for a family with minor children may be vastly different for a person or couple entering retirement. As we age, it is important to consider how paying for the long-term care health costs needs of an unhealthy spouse can impact the ability of the healthy spouse to sustain him or herself in the community. Understanding the laws that determine eligibility for valuable government programs such as Medicaid and Veterans Benefits can become important. Many people do not realize that a proper estate plan can ensure the best results possible if a person or couple is faced with such a situation.

It is not uncommon for clients to have established a trust as part of their estate plan. The trust may be revocable and intended to allow for assets to pass to beneficiaries without the costs, delay and lack of privacy associated with the probate process. Or, the trust may be irrevocable and, in addition to the above objectives, intended to accomplish a certain estate tax, income tax or Medicaid objective. Some or all of those objectives may be frustrated if the trust is not funded properly. Reviewing your estate plan with your legal and financial advisors is important to determine whether all of your current assets are properly titled or beneficiary designated so that each of the plan’s goals and objectives are actually accomplished.

We strongly recommend you review your estate plan with your legal and financial advisors at least every three or four years and more frequently as you age or after one of the significant life events noted above. For more information, please contact PLDO Partner Rebecca M. Murphy at 401-824-5100 or email rmurphy@pldolaw.com.

[back to top]

|

|

• allow part-time workers who work less than 1,000 hours a year to contribute to a 401(k) plan;

• allow part-time workers who work less than 1,000 hours a year to contribute to a 401(k) plan;

The “How”

The “How”